[UPDATED OCTOBER 5, 2021]

Background

Section 340B of the Public Health Service (PHS) Act requires drug manufacturers participating in the Medicaid Drug Rebate Program (MDRP) to sign a pharmaceutical pricing agreement (PPA) with the Secretary of Health and Human Services (HHS) to offer covered outpatient drugs at or below statutory ceiling prices to certain covered entities. The 340B Drug Pricing Program (340B Program) is administered by the Health Resources and Services Administration (HRSA).

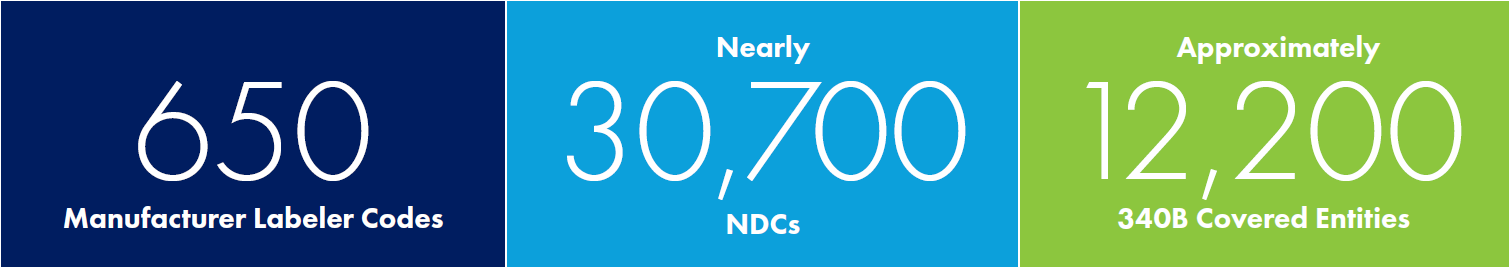

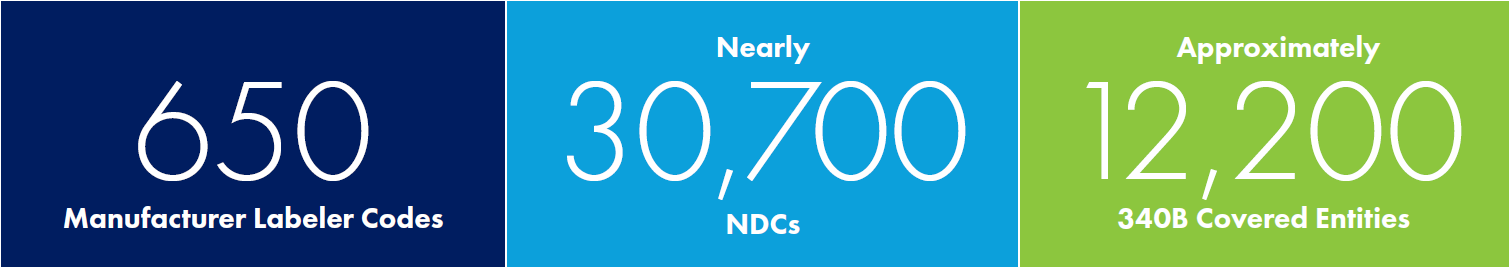

340B by the Numbers

HRSA establishes program policy for manufacturers and covered entities. On January 5, 2017, HRSA issued the 340B Ceiling Price and Civil Monetary Penalties Final Rule (340B CMP Final Rule), which became effective January 1, 2019. The 340B CMP Final Rule includes key requirements for manufacturers and establishes CMPs for manufacturers that knowingly and intentionally overcharge covered entities.

In accordance with the section 340B of the PHS Act, HRSA is required to collect information from manufacturers to verify the accuracy of 340B ceiling prices, and then make ceiling prices available to covered entities. To this end, HRSA developed the new secure pricing component of the Office of Pharmacy Affairs Information System (OPAIS), which provides covered entity and manufacturer authorized users with access to 340B ceiling prices.

The purpose of this article, prepared by Apexus, the 340B Prime Vendor, is to provide an overview of the CMP Final Rule and the pricing component of the 340B OPAIS. In addition, we share best practices on how to achieve compliance and operational efficiencies.

What Is the HRSA 340B Prime Vendor?

Apexus serves as the Prime Vendor for the 340B Drug Pricing Program. As the 340B Prime Vendor, Apexus manages program distribution and serves as a partner to all 340B stakeholders in improving the 340B Program’s overall integrity. The Prime Vendor also provides education and compliance tools to 340B stakeholders. Additional information about the Prime Vendor Program is available at 340Bpvp.com.

Key Regulatory Changes: 340B Ceiling Price Calculation and Civil Monetary Penalties Final Rule

340B Ceiling Price Calculation

Overview: The 340B CMP Final Rule explains that the 340B ceiling price for a covered outpatient drug is equal to the average manufacturer price (AMP) from the preceding calendar quarter for the smallest unit of measure minus the unit rebate amount (URA), and will be calculated using six decimal places. The CMP Final Rule established that the ceiling price will be rounded to two decimal places and will be published in the 340B OPAIS on a quarterly basis. When the 340B ceiling price is less than $0.01, it will be published in the 340B OPAIS as $0.01 and the manufacturer must charge covered entities $0.01 per unit of measure.

For new drugs, an AMP may not be available until the fourth quarter that the drug is available for sale. However, the CMP Final Rule requires manufacturers to estimate and make available the 340B ceiling price for a new covered outpatient drug as of the date the drug is first available for sale. For the purpose of calculating new drug prices, the calculated estimate is wholesale acquisition cost (WAC) minus the appropriate rebate percentage until AMP is available, which is no later than the fourth quarter that the new drug is available for sale. This new drug price estimation in the 340B CMP Final Rule is to ensure that manufacturers have a standard method for estimating the 340B ceiling price of a new covered outpatient drug to ensure that covered entities receive the 340B ceiling price on their purchases.

In addition, for new drugs, manufacturers are required to calculate the actual 340B ceiling price and offer to refund or credit to the covered entity the difference between the estimated 340B ceiling price (WAC minus URA) and the actual 340B ceiling price within 120 days of the determination by the manufacturer that an overcharge occurred. An instance of overcharging may occur either at the time of initial purchase or with subsequent ceiling price recalculations, due to pricing data submitted to the Centers for Medicare and Medicaid Services (CMS) or new drug price estimates, resulting in a covered entity paying more than the ceiling price.

For more information, please review the 340B CMP Final Rule (82 Fed.Reg. 1210, January 5, 2017).

Best Practices:

- New Drugs:

- Establish internal procedures that follow the new drug pricing methodology (WAC minus URA) when establishing the initial 340B ceiling price. HRSA notes that while this methodology for estimating the 340B ceiling price for drugs is required, it needs to occur only as long as an average manufacturer price (AMP) is not available. Once a manufacturer knows the AMP, it can calculate and begin to offer the actual 340B ceiling price and refund only for the time period when the estimation occurred and there was a difference between the estimated and actual 340B ceiling price.

- Existing Drugs:

- Information in the Medicaid Drug Data Reporting System (DDR) should be updated to avoid price discrepancies. If a manufacturer provides to HRSA different data than what is in the DDR, the manufacturer will be required to reconcile and update the information accordingly.

- Be aware that the 340B ceiling price is first calculated to the sixth decimal place, and the ceiling price offered to covered entities is rounded to two decimal places when published.

Civil Monetary Penalties

Overview: HRSA has the authority to impose civil monetary penalties on manufacturers that “knowingly and intentionally” overcharge a 340B covered entity more than the 340B ceiling price. These penalties would be in addition to refunds of overcharges to covered entities.

HRSA states that instances of overcharging may occur at the time of the original sale or when recalculations of the 340B drug price occur. The HHS Office of Inspector General (OIG) has delegated authority to impose CMPs and to interpret the meaning of “knowingly and intentionally” on a case-by-case basis using the definitions, standards, and procedures under the federal regulation.

Best Practices:

- Ensure that appropriate staff from required departments are educated about the 340B CMP Final Rule and potential impact. Review the regulation here. HRSA expects covered entities and manufacturers to work in good faith to resolve any overpayments in accordance with standard business practices. If a manufacturer determines that it has charged covered entities more than the 340B ceiling price, manufacturers should notify HRSA of their intention to issue a refund. The 340B Prime Vendor has a voluntary program to help manufacturers refund money primarily through a distributor credit to the covered entity’s 340B wholesaler account.

- Develop business rules and standard procedures for offering refunds to covered entities in the case of overcharges. Solicit internal cross-functional expertise from areas such as government pricing, contract operations, compliance, public policy, and legal. When necessary, solicit support from external counsel, consultants, or the 340B Prime Vendor. Although the 340B CMP Final Rule addresses a timeframe for repayment on overcharges related to new drugs, HRSA expects repayment (refunds) to be made on all overcharges to covered entities in accordance with normal business practices.

- Have an efficient plan to process refunds. Consider potential costs such as due diligence calls, returned mail and/or checks leading to subsequent mailings, and tax requirements of obtaining W-9 forms from covered entities in accordance with normal business practices.

- Gain awareness of resources available to assist with compliance. Refer to the HRSA 340B Program website to ensure compliance and locate resources such as Manufacturer Notices to Covered Entities and Manufacturer Resources, including FAQs. The Prime Vendor also has resources available to assist with compliance.

- Monitor 340B pricing offered by your distributor network. Manufacturers are held liable even when the cause of an overcharge was a wholesaler error. Because manufacturers are responsible for setting appropriate 340B ceiling prices, they are responsible for the conduct of business partners with whom they contract.

Operational Changes: OPAIS Pricing System

Overview: The 340B OPAIS pricing component captures pricing data from manufacturers and CMS and then calculates and verifies 340B ceiling prices through a quarterly process. The system was designed to increase the integrity and effectiveness of 340B information from participating manufacturers. Manufacturers made their initial submissions of 340B pricing data to the secure pricing component of OPAIS during the first quarter of 2019, and 340B ceiling prices were available to covered entities on April 1, 2019.

Best Practices:

- Ensure that your Authorizing Official (AO) and Primary Contacts (PCs) are current and up to date for each labeler code, and that authorized user information is updated in a timely manner when internal responsibilities change. This is an expectation from HRSA. The manufacturer’s AO and PC have responsibility for providing quarterly pricing data for each labeler code, either manually or via text file upload. The AO and PC access their respective accounts using their email addresses and following a two-step authentication code.

- The PC may submit 340B ceiling prices, so please ensure that you have the appropriate level personnel listed.

- If you have multiple labeler codes, be prepared to submit pricing for each. Each labeler code has an AO and PC listed, so manufacturers should verify whether or not the same person is responsible for all or some of its labeler codes as AO and PC.

- Visit the 340B OPAIS Educational Resource web page and sign up for program updates. Review the Manufacturer Compliance FAQs here. Recent enhancements (effective May 2021) have been made to the standard notes options. These notes options are now available as a drop-down menu for manufacturers to use when providing a reconciliation note for data point discrepancies between manufacturer and HRSA data. The drop-down menu will populate a note in the notes field that may be edited by the manufacturer to provide a more detailed explanation of a particular reconciliation for why a data point differs from HRSA’s data. If the manufacturer prefers to provide its own note or has a reconciliation reason that is not covered by the standard drop-down options, the “other” option in the drop-down will provide a blank notes field for the manufacturer to add its own detailed note.

- Ensure that all internal calculations are completed in a timely manner so that the authorized users are able to submit the data into the system. HRSA requests that manufacturers report 340B pricing data (instrument file) for all NDCs within a two-week submission period beginning approximately 45 days after the end of the previous quarter. These data are compared with the HRSA data on file (AMP and URA from CMS), PS (package size), and CSP (case package size) from First Data Bank (FDB).

- Failure to reconcile by the end of the manufacturer upload period will result in the 340B pricing component taking HRSA data points.

- In the case of new drug prices, the manufacturer should submit WAC (at the unit level) as a replacement for AMP and the required rebate percentage as the URA (as a value). The submitted WAC is as of the first day of the next quarter and is used to calculate the estimated ceiling price in accordance with the CMP Final Rule and is the price effective for the next quarter.

- For NDCs that have not appeared in the MDRP drug product file for the previous three quarters, OPAIS will prompt manufacturer users to answer two questions as part of the product’s reconciliation (effective May 2021).

- A. Is this a new drug (i.e., not previously reported to DDR for the previous four quarters)?

- B. Is this a new drug price estimate (i.e., AMP not yet established; therefore, the ceiling price estimated as WAC is less than the appropriate rebate percentage)?

- If the manufacturer answers no to both question A and B, then it will not be prompted in the future for reconciliation.

- If the manufacturer answers yes to question A, but no to question B, then it will not be prompted in the future for reconciliation.

- If the manufacturer answers yes to both questions, then it will be required to answer for up to 4 consecutive quarters or until it answers no to the drug estimate.

For an NDC that is identified as a new drug price estimate, a display flag with **** will display in the product search fields. The **** notation will be visible to the submitting manufacturer and eligible covered entities that have access to OPAIS pricing component.

- Ensure internal procedures and personnel are in place to address pricing inquiries from covered entities.

- Additional OPAIS Pricing navigation/user tips include:

- When reconciling a difference from CMS data for AMP or URA, provide a detailed reason for the difference and note whether the information has been updated/restated in DDR or with CMS separately.

- Package size should be provided in the same units as the AMP is reported to CMS.

- Case package size should reflect the number of salable units in a shipping container that an individual purchaser would receive (what a covered entity would purchase rather than what a wholesaler would receive from a manufacturer).

- If NDCs are sold or transferred, the selling and acquiring manufacturer should establish a relationship for submitting pricing.

- If a few lines of the text file have errors, manual entry for those products may be easier to submit than trying to re-upload the entire file.

- If accurate and updated information is provided for the quarterly submission to CMS, there should be less work needed for manufacturers to reconcile in OPAIS.

Summary

The 340B CMP Final Rule and the implementation of the new secure pricing component of the 340B OPAIS have significant impact, including CMPs for manufacturers that knowingly and intentionally overcharge covered entities.

In addition to continuing to monitor 340B Program developments, manufacturers should ensure that appropriate staff understand program requirements and are diligent in documenting and following updated operational procedures and business assumptions. Many resources are available to assist in this process, including the HRSA 340B website and the 340B Prime Vendor Program, including Apexus Answers.